The National Pension System (NPS) is one of the most reliable and cost-effective ways to secure your financial future. In a fast-paced world where expenses continue to rise, the importance of a robust retirement plan cannot be overstated. If you’re wondering, “Should I invest in NPS?” the answer is a resounding yes—especially in 2025.

As a government-backed scheme, NPS offers tax benefits, long-term returns, and a well-structured approach to wealth creation. Let’s explore why you should invest in NPS in 2025 as part of your financial portfolio.

What Is NPS?

The National Pension System is a retirement-focused investment scheme introduced by the Government of India in 2004. Initially targeted at government employees, it was later extended to all citizens.

Here’s how it works:

- You contribute periodically to your NPS account.

- The funds are managed by professional fund managers, allocated across equity, corporate bonds, and government securities.

- Upon retirement, you can withdraw a portion as a lump sum while the remaining is used to purchase an annuity for a steady income.

Regulated by the Pension Fund Regulatory and Development Authority (PFRDA), NPS is a trustworthy avenue for securing your post-retirement life.

1. Tax Benefits Under Section 80C and 80CCD

One of the most appealing features of NPS is its tax-saving potential. As per the Income Tax Act, contributions to NPS qualify for deductions under:

- Section 80C: Up to ₹1.5 lakh annually.

- Section 80CCD(1B): An additional deduction of ₹50,000 beyond the Section 80C limit.

This means you can save up to ₹2 lakh in taxable income each year. Compared to other tax-saving instruments like ELSS or fixed deposits, NPS provides a more comprehensive tax benefit structure.

2. Low-Cost Investment Option

NPS is renowned for its low-cost structure, making it an attractive choice for long-term investors. With fund management charges capped at 0.09%, your returns remain largely unaffected by overhead expenses.

Other investment options like mutual funds or ULIPs often come with higher expense ratios, reducing overall profitability. With NPS, you get a transparent and affordable mechanism for growing your retirement savings.

3. Flexibility in Contribution

Whether you’re a salaried employee or self-employed, NPS offers unmatched flexibility in contributions. There’s no fixed mandate—you can contribute as per your financial comfort.

- Minimum Contribution: ₹1,000 per year.

- Maximum Contribution: No limit.

This adaptability ensures that NPS suits individuals across income brackets, allowing you to align your investment with personal goals. This level of flexibility is another compelling reason why you should invest in NPS in 2025.

4. Diversified Investment Portfolio

A diversified portfolio is key to reducing risk, and NPS excels in this domain. It allows you to invest in a mix of:

- Equity (E): High growth potential.

- Corporate Bonds (C): Stable returns.

- Government Securities (G): Low-risk investments.

Professional fund managers ensure optimal asset allocation, giving you a balanced mix of growth and security.

5. Guaranteed Pension After Retirement

Unlike many other investment options, NPS guarantees a steady income post-retirement. By mandating the purchase of an annuity with at least 40% of the accumulated corpus, NPS ensures financial stability in your golden years.

With rising healthcare costs and inflation, a guaranteed pension becomes a crucial safety net for retirees.

Recommended Read: Financial literacy for Gen Z: Essential tips

6. Portable and Convenient

One of the unique advantages of the National Pension System is its portability. Unlike employer-specific provident funds or fixed investments tied to a region or bank, NPS stays with you, no matter where you go.

Here’s how portability works in NPS:

- Across Jobs: Whether you switch jobs or industries, your NPS account remains active and unaffected.

- Across Locations: Moving between cities or states? No problem—your NPS account moves with you.

- Centralized Access: With a Permanent Retirement Account Number (PRAN), you can manage your account online from anywhere.

This feature ensures that your investment journey is seamless, even during major life transitions. Additionally, digital platforms make it easier than ever to track, contribute, and adjust your NPS investments.

7. Long-Term Wealth Creation

Investing in NPS allows you to harness the power of compounding over time, making it an excellent tool for long-term wealth creation. The earlier you start, the larger your corpus grows due to the reinvestment of returns.

Why NPS is a great choice for long-term goals:

- Equity exposure delivers higher returns compared to traditional savings schemes.

- Regular contributions accumulate into a significant corpus over the years.

- The mix of debt and equity ensures growth while minimizing risks.

If building a secure financial future is your goal, why you should invest in NPS in 2025 becomes clear—it’s a reliable tool for long-term wealth creation.

8. Financial Security for Old Age

Retirement planning isn’t just about saving money—it’s about ensuring peace of mind. With increasing life expectancy and inflation, having a steady source of income post-retirement is essential.

NPS addresses these challenges effectively by providing:

- Regular Pension Income: A reliable annuity ensures that you don’t outlive your savings.

- Rising Cost Coverage: With diversified returns, NPS helps counter inflation’s impact on your purchasing power.

- Healthcare Cushion: Rising medical expenses can derail financial plans, but NPS ensures you have a safety net.

This financial security is invaluable for leading a stress-free, independent retired life.

How to Start Investing in NPS

Starting your NPS investment is simple and can be done online or offline. Follow these steps to get started:

- Eligibility: Ensure you’re between 18 and 70 years of age.

- Documents Needed:

- Aadhaar or PAN card for ID verification.

- Address proof.

- Recent passport-sized photograph.

- Application Process:

- Online: Use the eNPS portal for a hassle-free digital process.

- Offline: Visit a Point of Presence (PoP) like a bank or financial institution.

Once your account is set up, you’ll receive a PRAN (Permanent Retirement Account Number) to manage your account.

For more details on opening an NPS account, visit the official NPS website.

Things to Consider Before Investing in NPS

While NPS is an excellent investment choice, it’s essential to understand its key features and limitations:

- Lock-In Period:

- NPS is a long-term investment with withdrawal restrictions until the age of 60.

- Partial Withdrawals:

- Allowed under specific circumstances like higher education, medical emergencies, or marriage of children.

- Annuity Mandate:

- A portion of the corpus must be used to purchase an annuity, which can limit immediate liquidity.

Understanding these factors ensures that NPS aligns with your financial goals and expectations.

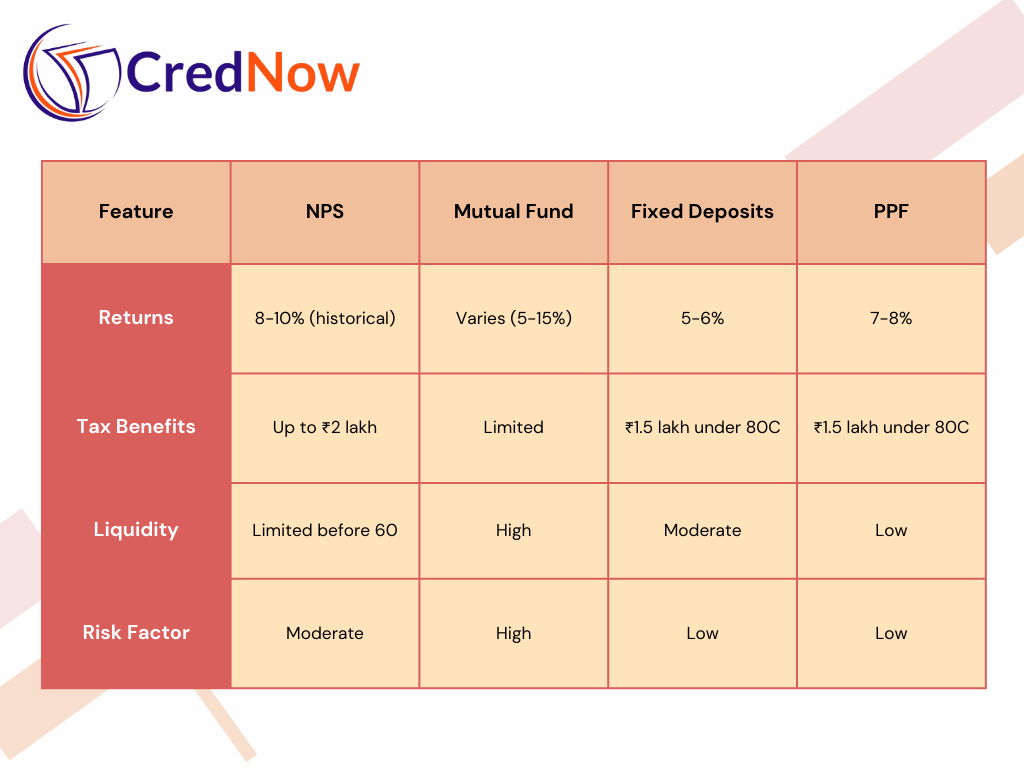

Comparing NPS With Other Investment Options

When deciding, it’s helpful to compare NPS with other popular investment instruments:

NPS stands out for its combination of tax savings, diversification, and low costs.

Also Read: How to Invest in SIP for Smart Financial Growth

Conclusion

Investing in NPS in 2025 is a smart move for anyone looking to secure their financial future. With its tax benefits, low costs, and diversified portfolio, NPS checks all the boxes for a robust retirement plan.

As life expectancy increases and expenses rise, taking proactive steps toward financial independence has never been more critical. Start today and enjoy the peace of mind that comes with knowing your retirement is secure

FAQs About Investing in NPS in 2025

- Should I invest in NPS if I’m in my 30s?

Absolutely! Starting early allows you to maximize the benefits of compounding and build a significant retirement corpus. - What happens if I stop contributing to NPS?

Your account remains active, but it’s advisable to contribute regularly to ensure growth and avoid penalties. - Can NRIs invest in NPS?

Yes, Non-Resident Indians (NRIs) can invest in NPS, provided they meet the eligibility criteria. - What is the minimum annual contribution for NPS?

You must contribute at least ₹1,000 annually to keep your account active. - Is NPS better than PPF?

While both have their benefits, NPS offers higher returns and greater flexibility, making it ideal for retirement planning.