At some point, most of us face a situation where we need extra money—maybe it’s for an unexpected car repair, a surprise medical bill, or an opportunity to start a long-held business idea. When these situations arise, two common choices frequently spring to mind: credit cards and personal loans. But which one is the better choice? The answer depends on your specific financial needs, repayment capacity, and goals. Here’s a detailed look at personal loans vs credit cards to help you make an informed choice.

Understanding Personal Loans and Credit Cards

What are personal loans?

A personal loan is a lump sum borrowed from a bank, NBFC, or online FinTech lender that you pay back over a fixed term with regular monthly payments. Most personal loans have fixed interest rates, giving you predictable payments throughout the loan term. They’re typically used for larger, planned expenses or to consolidate debt.

What are credit cards?

A credit card offers a revolving line of credit, allowing you to borrow money up to a specified limit. You can repay the borrowed amount in flexible installments, but interest is charged on any outstanding balance. Credit cards often come with variable interest rates, making the cost of borrowing less predictable if you carry a balance.

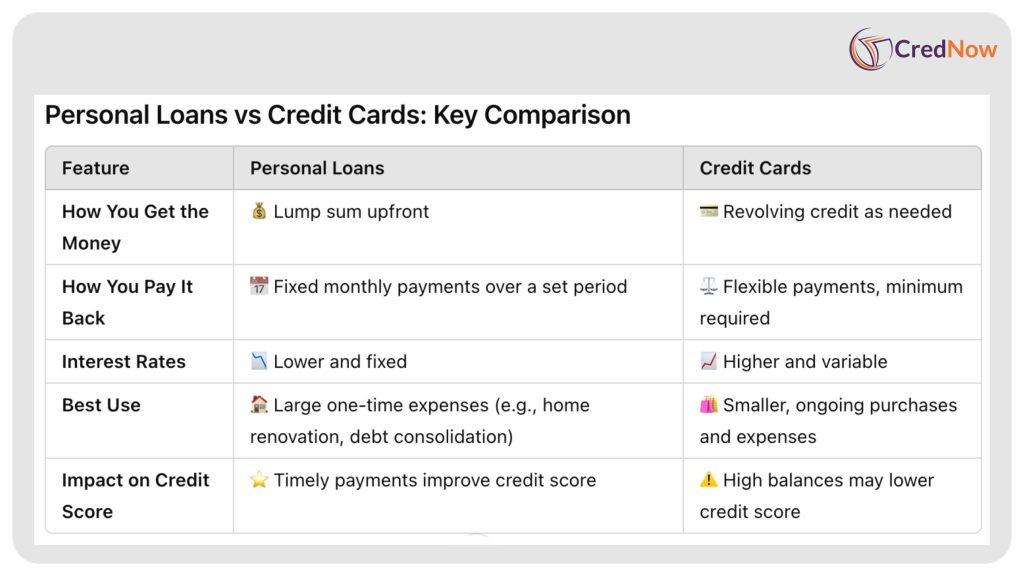

Key Differences Between Personal Loans and Credit Card

1. How You Access Funds

Personal Loans: The entire loan amount is disbursed to you upfront, making it ideal for large, one-time expenses.

Credit Cards: You can borrow as needed, up to your credit limit, offering more flexibility for smaller or ongoing expenses.

2. Repayment Structure

Personal Loans: Fixed monthly payments over a set period (e.g., 3 to 5 years). This structure helps with budgeting since the payment schedule is predictable.

Credit Cards: Flexible repayment options, with a minimum payment required each month. However, carrying a balance can lead to high interest charges over time.

3. Interest Rates

Personal Loans: Generally lower and fixed, providing stability.

Credit Cards: Often higher and variable, meaning the cost of borrowing can increase if you don’t pay off your balance in full.

4. Best Use Cases

Personal Loans: Large, planned expenses like home renovations, medical bills, or consolidating high-interest debts.

Credit Cards: Everyday purchases, recurring bills, or short-term borrowing where you can pay off the balance monthly.

5. Impact on Credit Score

Personal Loans: Making on-time payments can boost your credit score, as the debt is installment-based and often seen as less risky by lenders.

Credit Cards: Keeping balances low relative to your credit limit and paying on time can positively impact your credit score. However, maxing out your card or missing payments can harm your credit.

Recommended Read | Credit Score Facts vs. Fiction: 10 Myths That Are Hurting Your Financial Future

When to Choose a Personal Loan

A personal loan might be the better option if:

- You’re Facing a Large, Planned Expense: Whether it’s for a major home repair, a wedding, or medical costs, a personal loan provides the lump sum you need upfront.

- You Want to Consolidate Debt: If you have multiple high-interest credit card balances, combining them into a single loan with a lower interest rate can simplify payments and save money.

- You Need Predictability: Fixed interest rates and set monthly payments make it easier to budget.

Watch Now: 5 Essential Steps to Personal Loan Success

When to Opt for a Credit Card

A credit card might be the smarter choice if:

- You Have Smaller, Ongoing Purchases: Groceries, utility bills, or occasional online shopping can easily be managed with a credit card.

- You Can Pay Off the Balance Monthly: Avoid interest charges altogether by paying the full balance each billing cycle.

- You Want Rewards and Perks: Many credit cards offer cashback, travel points, purchase protection, and other benefits that can add value to your spending.

Key Considerations Before Deciding

- Interest Rates: Personal loans typically offer lower interest rates, but credit cards can be interest-free if balances are paid off monthly.

- Repayment Flexibility: Credit cards provide more repayment flexibility, but carrying a balance can lead to steep interest costs.

- Credit Impact: Both options influence your credit score, so make timely payments and manage your debt responsibly.

Making the Right Choice

The decision between personal loans vs credit cards depends on your financial situation and borrowing needs. Here’s a simple breakdown:

- Choose a Personal Loan if you need a large amount of money for a planned expense, prefer fixed payments, or want to consolidate high-interest debt into one manageable payment.

- Opt for a Credit Card if you’re making smaller, frequent purchases, can pay off the balance each month, or want to take advantage of rewards and perks.

Final Thoughts

When it comes to personal loans vs credit cards, the right choice isn’t about which option is objectively “better” but which aligns with your financial goals and capacity to repay. Take the time to evaluate your needs, compare interest rates and terms, and consider how each option fits into your overall financial plan. With a little thought and planning, you can make a decision that sets you up for success—whether that’s tackling a big expense or managing your everyday spending.

FAQs

1. What are the main differences between personal loans and credit cards?

Personal loans provide a lump sum amount with fixed repayment terms and generally lower interest rates. Credit cards, on the other hand, offer a revolving line of credit with flexible repayment options but typically higher and variable interest rates.

2. Which option is better for consolidating debt: personal loans or credit cards?

A personal loan is often better for debt consolidation. It allows you to combine multiple high-interest debts into one fixed payment with a lower interest rate, making it easier to manage and potentially reducing the overall cost.

3. When should I choose a credit card over a personal loan?

Credit cards are more suitable for smaller, ongoing expenses or short-term borrowing. They are ideal if you can pay off the balance in full each month to avoid interest and enjoy perks like rewards or cashback.

4. How does the interest rate differ between personal loans and credit cards?

Personal loans typically have lower, fixed interest rates ranging from 8-15% (depending on your credit score and lender), while credit cards generally have higher rates, often between 18-25%, which may vary based on your balance and payment habits.

5. Can both personal loans and credit cards affect my credit score?

Yes, both can impact your credit score. Timely payments on personal loans improve your credit history, while high credit card balances can negatively affect your credit utilization ratio. Regular payments and managing debt responsibly are crucial for both options.