Credit Cards in the Digital Finance Age have evolved remarkably since their inception in the early 20th century. Today, they are not just an alternative source of emergency funds but essential tools for online shopping, contactless payments, and a wide array of financial services accessible at our fingertips.

In this digital age, credit cards offer unparalleled convenience, security, and financial flexibility. They have become integral to managing personal finances as they are seamlessly integrated with e-commerce platforms, digital wallets, and financial apps. This trend is particularly evident in India, where credit card usage is soaring. As of December 2023, there were 97.9 million active credit cards, with 1.9 million new cards issued, according to the Reserve Bank of India (RBI).

This guide will walk you through everything you need to know about Credit Cards in the Digital Finance Age, from how they work to using them responsibly to build a strong financial future.

How Do Credit Cards Work in the Digital Finance Age?

When you use a credit card, the transaction follows a complex yet swift process. Banks issue credit cards and set terms like credit limits and interest rates. Payment networks (RuPay, Visa, Mastercard, American Express) facilitate transactions between the merchant and the issuing bank to ensure seamless processing.

Credit cards have embraced modern technology with features like contactless payments (tap-to-pay) and digital wallets (Paytm, PhonePe, Apple Pay, Google Wallet). These innovations offer enhanced convenience and security, making transactions faster and reducing the need for physical cards.

Here’s a simplified breakdown of a credit card transaction in the digital finance age:

- Purchase: You make a purchase using your credit card.

- Authorization: The merchant’s bank contacts your card issuer through a payment network.

- Approval: Your card issuer approves the transaction if you have sufficient credit available.

- Payment: The merchant receives payment, and the amount is added to your credit card balance.

- Billing: At the end of your billing cycle, you receive a statement and can choose to pay in full or carry a balance. This process happens in seconds, whether you’re shopping online, tapping your card for a contactless payment, or using your smartphone’s digital wallet.

Benefits of Using Credit Cards in the Digital Finance Age

Credit cards offer numerous advantages in our increasingly digital world:

- Convenience and Security: Make purchases in-store, online, or over the phone with robust security features like fraud protection.

- EMI Facility: Split large purchases into manageable monthly payments, often cheaper than personal loans.

- Flexible Credit: Enjoy a 45-day to 60-day interest-free period, effectively providing a short-term, no-cost loan.

- Rewards and Cashback Programs: Earn cashback, points, or rewards on spending, redeemable for travel, merchandise, or statement credits.

- Building Credit Score: Responsible use helps build and improve your credit score, demonstrating financial responsibility to lenders.

- Fraud Protection and Purchase Insurance: Benefit from better fraud protection than debit cards and extended warranties or purchase protection on items bought.

Recommended Read: Smart Tips to Use a Credit Card Wisely: Boost Your Financial Health

Discover the Best Credit Card Offers Curated for You in the Digital Finance Age

Understanding credit card basics to use credit cards effectively, it’s crucial to understand some key terms:

- Credit Limit: The maximum amount you can borrow is determined by your income, credit score, and existing debts.

- Interest Rates: The Annual Percentage Rate (APR) is the yearly rate charged for borrowing. Pay your balance in full each month to avoid interest on purchases.

- Grace Period: The time between the end of a billing cycle and your payment due date. Paying in full during this period means no interest charges on new purchases.

- Minimum Payment: The lowest amount you can pay to keep your account in good standing. However, paying only the minimum can lead to substantial interest charges over time.

- Balance Transfer: Transferring debt from one credit card to another, often to take advantage of lower interest rates. Be aware of potential transfer fees.

- Cash Advance: Withdrawing cash using your credit card, often with high fees and interest rates, should be used sparingly.

Must Read: Essential things to know before applying for a Personal Loan

Building Credit with Credit Cards in the Digital Finance Age

One of the most significant benefits of credit cards is their ability to help you build a strong credit history. Your credit score is a numerical representation of your creditworthiness, based on factors like your payment history, credit utilization, and length of credit history.

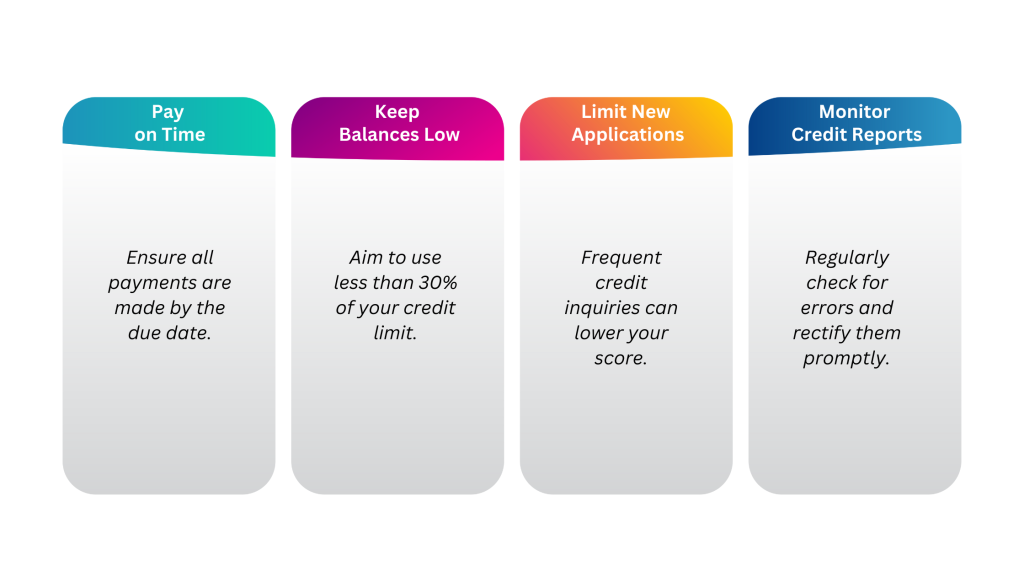

Using a credit card responsibly—making payments on time and keeping your balance low relative to your credit limit—can significantly improve your credit score over time. This, in turn, can help you qualify for better loan terms and lower interest rates in the future.

Responsible Credit Card Use in the Digital Finance Age

While credit cards offer many benefits, they also require responsible management. Here are some tips for using your credit card wisely:

- Create a Budget: Know how much you can afford to spend each month and stick to it. Many mobile banking apps offer tools to help you track your spending and set budgets.

- Track Your Expenses: Regularly review your credit card statements to spot fraudulent charges and understand your spending habits.

- Pay Your Bill on Time: Late payments can result in fees and negatively impact your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

- Avoid Carrying a Balance: Whenever possible, pay your full balance each month to avoid interest charges. If you can’t pay in full, pay as much as you can above the minimum payment.

- Use Credit Card Rewards Wisely: Maximize your rewards without overspending just to earn points or cashback.

Final Thoughts

Credit cards are powerful financial tools that, when used responsibly, can provide convenience, security, and financial benefits. Credit cards are likely to become even more integrated with our digital lives, with increased use of contactless payments, more sophisticated reward programs, and better integration with budgeting and financial planning tools.

The key to success with credit cards is to use them as a financial management tool, not as a source of extra income. By understanding how they work and using them responsibly, you can leverage credit cards to build a strong financial foundation for your future. Whether you’re just starting with your first credit card or looking to make better use of the cards you have, this guide should give you a solid foundation.

FAQs:

1. What is a credit card?

A credit card is a financial tool issued by banks or credit institutions that allows you to borrow money up to a certain limit to pay for goods and services. The borrowed amount needs to be repaid, usually on a monthly basis. If you repay the full balance within the grace period, you typically avoid interest charges.

2. How to increase a credit card limit?

To increase your credit card limit, you can request a limit increase from your card issuer. Steps include maintaining a good credit score, demonstrating a stable income, regularly using your card but keeping the balance low, and consistently paying your bills on time. Some issuers may automatically increase your limit after a period of responsible use.

3. What is the minimum due on a credit card?

The minimum due is the smallest amount you need to pay by the due date to keep your account in good standing. It usually includes a percentage of the outstanding balance, plus any applicable fees and interest. Paying only the minimum due can lead to high-interest charges and prolonged debt repayment.

4. How do credit cards work?

Credit cards work by providing a line of credit from which you can borrow to make purchases. Each month, you receive a statement with your charges, and you must make at least the minimum payment by the due date. Interest is not charged if the entire amount is paid but will be charged on the outstanding amount if you do not pay the entire amount due.

5. Do credit cards impact credit scores?

Yes, credit cards impact your credit scores. Timely payments can improve your score, while late payments can lower it. Other factors include credit utilization (the percentage of available credit you are using), length of credit history, and types of credit used.

6. What are the different types of credit cards available?

Various credit card types cater to different needs:

- Various credit card types cater to different needs:

- Travel Credit Cards: Offer travel perks like air miles and lounge access.

- Cashback Credit Cards: Provide cashback on purchases.

- Shopping Credit Cards: Offer discounts or rewards at specific stores.

- Fuel Credit Cards: Give cash back or discounts on fuel purchases.

- Lifestyle Credit Cards: Provide benefits related to dining, entertainment, or luxury services.

7. What is APR on a credit card?

APR (Annual Percentage Rate) represents the annual cost of borrowing on a credit card, including interest and fees. It helps you understand the total cost of using credit over a year. A lower APR means lower overall borrowing costs.

8. What is a balance transfer credit card?

A balance transfer credit card allows you to move existing debt from one or more credit cards to a new card, typically with a lower interest rate. This can help you save on interest and pay off debt faster.

9. Can I have multiple credit cards?

Yes, you can hold multiple credit cards, depending on your creditworthiness and the approval criteria of the issuers. Managing multiple cards responsibly involves making timely payments and not overspending to avoid debt accumulation.

10. How can I use credit cards responsibly?

To use credit cards responsibly, pay your balance in full each month, keep your credit utilization low (preferably under 30%), avoid unnecessary debt, monitor your statements for errors or fraudulent charges, and only apply for new credit when necessary. This helps maintain a healthy credit score and financial well-being.